Earn highest DeFi yields on autopilot

DeFi agent finds the highest yields across DeFi and allocate your funds.

Today’s net APYs on

Today’s net APYs on

Base:

USDC 9.96%,

WETH 4.28%

.Non-Custodial

Autonomous

Decentralized

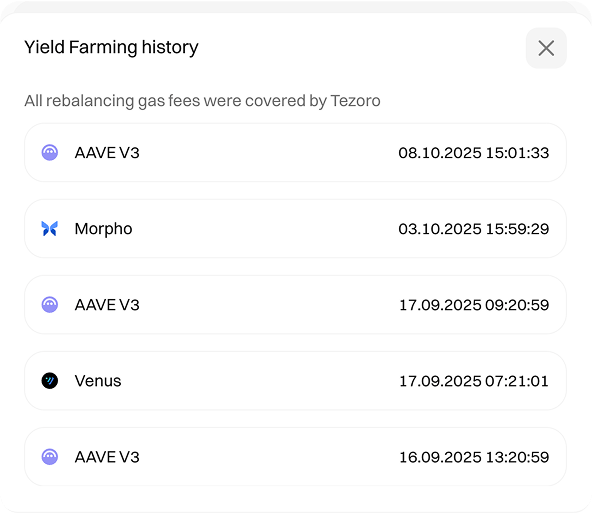

Gas-Free

Backed by grants and accelerators

Backed by grants & accelerators

Backed by founders & executives

How it works

Your Web3 Wallet

Deploy a DeFi agent (a smart contract) and allow it to manage your funds

DeFi Agent

Finds protocols with the highest APY and optimal utilization for each of your tokens

DeFi Protocols

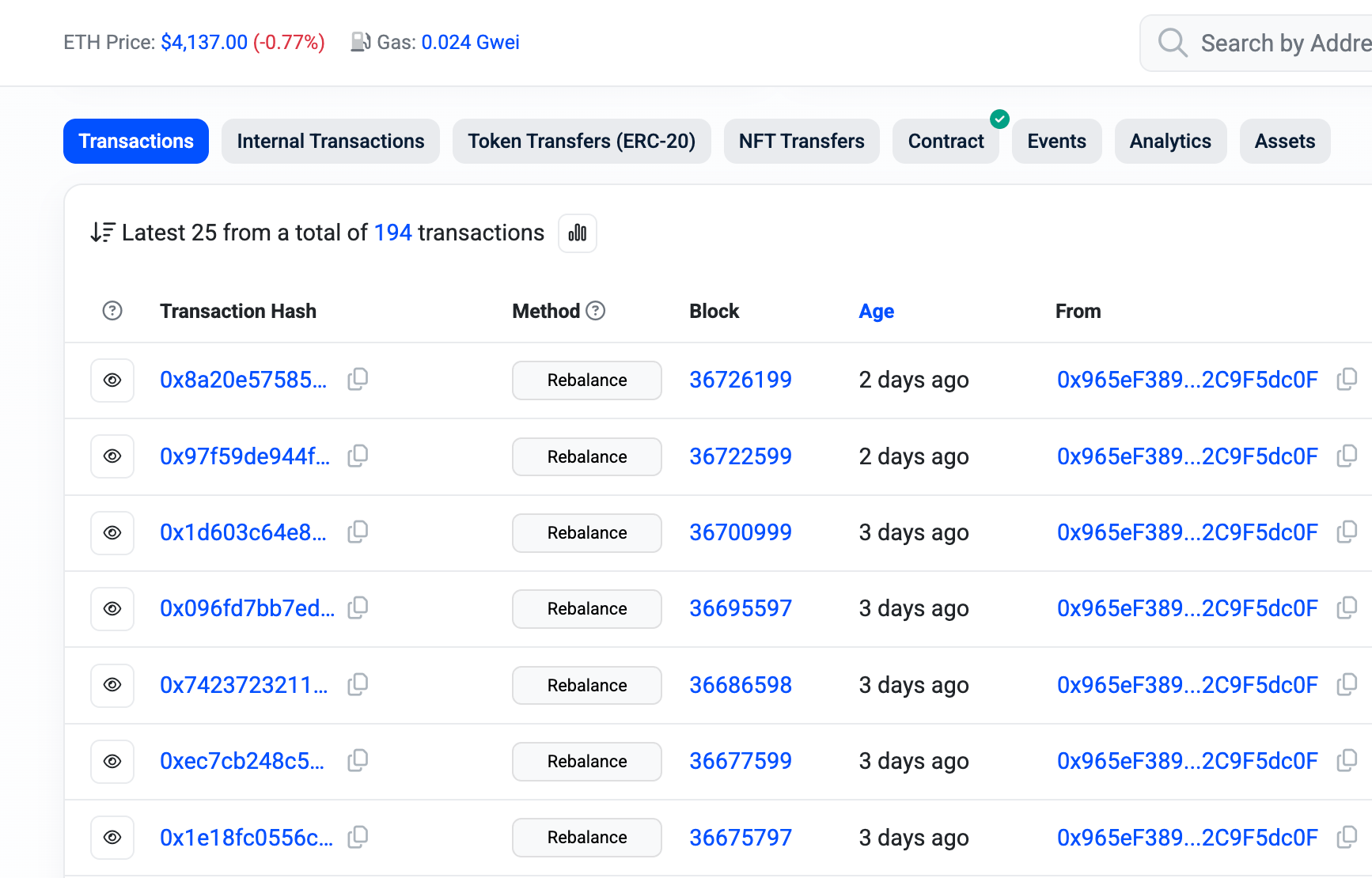

The agent autonomously rebalances your assets between DeFi protocols to generate the highest possible yield

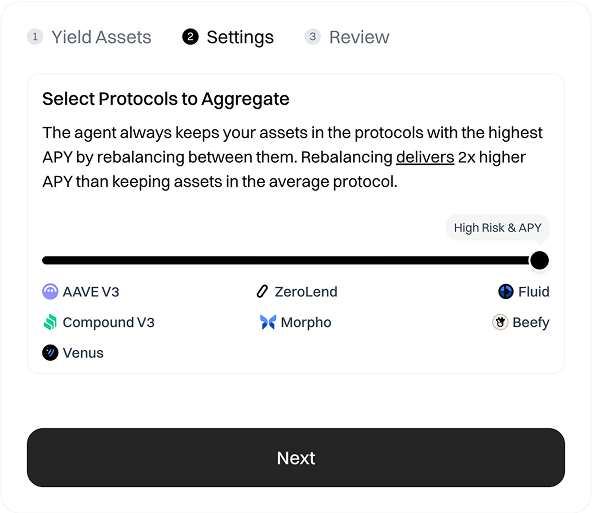

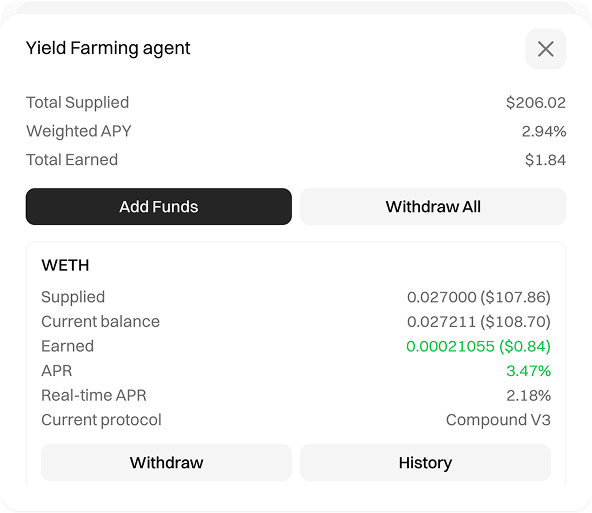

One agent, many protocols

Select protocols the agent can use for yield: Aave, Compound, Venus, Morpho, ZeroLend, Fluid, Beefy - and more to come

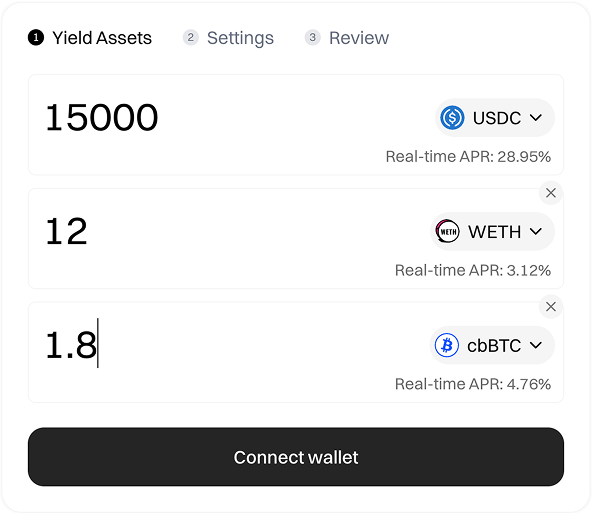

Multiple assets at once

Select assets and amounts - the agent will handle the rest

Yields on autopilot

The agent autonomously rebalances assets between protocols

Instant access to liquidity

Track all your positions at once and withdraw all in one click

Decentralized & non-custodial

Your DeFi agent is a smart contract owned solely by you, so you can interact with it directly on-chain without the Tezoro interface